Construction lending is complex. It involves stage-wise disbursements, NOC issuance, RERA compliance, and real-time project tracking. For Banks and NBFCs, managing all of this manually or through fragmented systems leads to delays, compliance gaps, and operational inefficiencies.

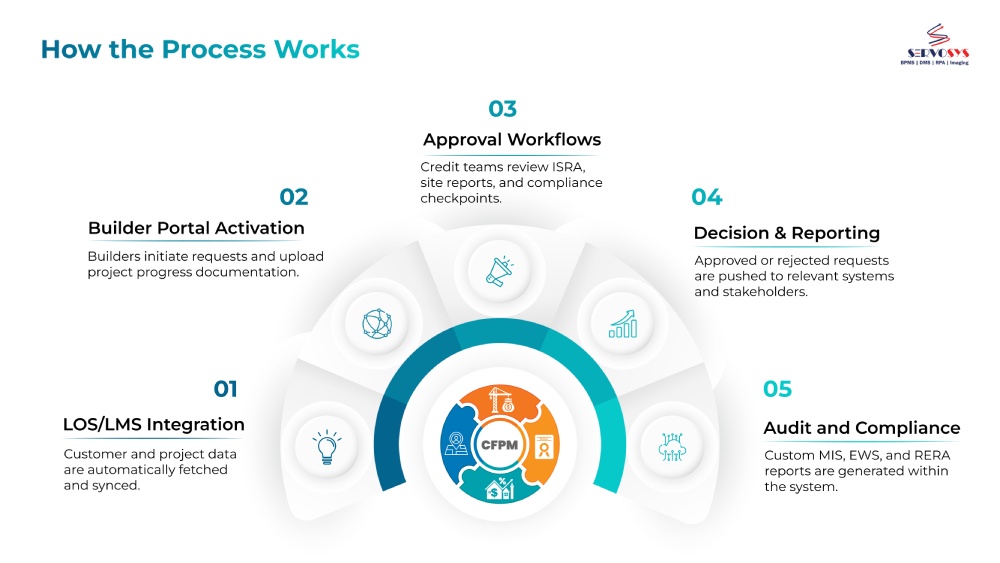

An advanced construction finance project monitoring solution like ServoCFPM addresses these gaps. It connects the entire loan monitoring lifecycle — from on-boarding to disbursement to compliance — into a single digital system.

Many Banks & NBFCs still face these roadblocks:

ServoCFPM is a purpose-built construction finance project monitoring solution for Banks & NBFCs. It connects with your existing LOS, LMS, and builder portals to automate the entire loan lifecycle — from onboarding and eligibility checks to disbursement and repayment. The platform helps streamline processes like NOC issuance, Stage-wise disbursement, ISIV checks, and project milestone tracking, all while reducing manual work and compliance risks.

With built-in RERA compliance, real-time dashboards, and centralized reporting, ServoCFPM empowers lenders to make faster, data-driven decisions. It’s more than just a construction loan management software — it acts as a project monitoring system and the best project tracking tool tailored for large-ticket real estate loans. Lenders gain full visibility, early risk alerts, and improved control across multiple construction projects.

Key Features of ServoCFPM

The Benefits – What is there for Banks & NBFCs

FAQs on Construction Finance Project Monitoring Solution

A construction finance project monitoring solution is a digital system designed to help Banks and NBFCs manage construction loans by tracking project progress, automating NOC issuance, managing disbursements, and ensuring regulatory compliance.

These institutions deal with complex, high-value loans that require continuous monitoring, compliance with RERA, milestone-based disbursements, and builder coordination — all of which are difficult to manage manually.

ServoCFPM offers builder onboarding, geo-tagged site inspections, Stage-wise disbursement approval workflows, automated capitalization, escrow integration, and centralized compliance reporting.

It seamlessly connects with LOS, LMS, CBS, and DMS systems, ensuring no duplication of work and providing real-time data exchange across departments.

Yes, it can reduce TAT from 3–4 days to same-day disbursement approval by digitizing and automating the NOC and disbursement process.

Yes, the system includes RERA-compliant workflows, automated reports, and centralized documentation to meet both state and central regulatory requirements.

The builder portal allows developers to submit requests, upload documents, track NOC status, and share booking MIS or cost certifications in real-time.

EWS monitors project delays, deviation from planned milestones, and receivable or collateral cover issues. It sends alerts to credit and risk teams to take preventive actions.

No. It is designed to work alongside your existing Loan Origination System or Loan Management System, adding a layer of project-level visibility and monitoring.

Absolutely. It supports multiple projects per builder, repeat/top-up loans, and centralized visibility for relationship managers, credit teams, and compliance heads.

ServoCFPM is more than just a construction finance project monitoring solution — it’s a comprehensive tool that brings speed, structure, and compliance to the entire construction loan lifecycle. By integrating with existing systems like LOS and LMS and providing a seamless builder portal, it ensures that all stakeholders have visibility and control over every stage of the project.

With built-in approval workflows, real-time reporting, and automated RERA compliance, banks and NBFCs can significantly reduce delays, manual errors, and financial risks.

For lenders managing high-value construction loans, having the right construction finance solution in place is no longer optional — it’s essential. ServoCFPM helps financial institutions stay compliant, serve builders faster, and scale their operations confidently.

Ready to transform your construction finance process?

Let’s connect for a quick demo and see how ServoCFPM can support your team.

For ServoCFPM inquiries, please write at: inquiry@servosys.com or visit the website: www.servosys.com

To know more and have the session with our solution-experts, call us at: +91- 120-5112541

Innovate, simplify, and expand with cutting-edge process automation solution.

Servosys Solutions is a unit of EML Consultancy Services Private Limited, a company headquartered in New Delhi, India. We are one of the fastest-growing providers of software products and technology services for business process automation solutions that address challenges like process turn-around time, organizational productivity, regulatory compliance, business scalability, operational visibility and excellence.

Adding {{itemName}} to cart

Added {{itemName}} to cart