From Branches to Mobile:

How Digital Lending Solutions Are Shaping the Future

With the rise of automation, the banking world has undergone quite the transformation. Nowadays, customers are all about speed and wish to have everything accessible right on their smartphones. And in the midst of all these changes, one revolution stands out: digital lending. It’s like this powerhouse that’s changing the game in banking.

From the days of traditional physical branches to the sheer convenience of mobile apps, the journey has been quite remarkable, hasn’t it? But what’s truly fascinating is how digital lending solutions have played a crucial role in pushing this transition.

Let’s dive into how these solutions have impacted the lending ecosystem and contributed to this remarkable transformation.

1. The Rise of Fintech-Led Digital Lending

The Credit Gap and Fintech’s Role: Traditional lending institutions often hesitated to serve low-income credit-deficient segments. This gap in credit availability paved the way for fintech-led digital lending platforms. These platforms, including non-banking financial companies (NBFCs), have revolutionized the lending landscape by leveraging seamless digital technologies. Their focus extends beyond just MSMEs to retail customers, offering a wide range of financial services.

Empowering Customers via Mobile Devices: Digital lending platforms have democratized access to credit. Customers can now apply for loans, whether it’s a small personal loan for a new TV or an educational loan, with ease. The process is streamlined, with minimal paperwork and eligibility checks. Mobile devices have become the gateway to financial inclusion, allowing borrowers to access credit anytime, anywhere.

2. The Numbers Speak: Growing Adoption and Market Size

Global Trends

- Consumer Adoption: In 2019, 64% of consumers worldwide used one or more fintech platforms, a significant increase from 33% in 20171. The awareness of fintech services stands at an impressive 96% globally.

- Mobile Banking: 60% of consumers prefer transacting with financial institutions through a single platform, such as social media or mobile banking apps1. The proliferation of smartphones has fueled the adoption of digital banking across various verticals.

India’s Digital Lending Landscape

- Market Size: India’s digital lending market was valued at USD 270 billion in 2022 and is projected to reach USD 350 billion. The growth rate of CAGR 39.5% over a decade highlights the sector’s dynamism.

- Future Vision: The digital lending industry in India is poised for further expansion. Initiatives like Aadhar adoption, Digilocker, Unified Payment Interface, and Digital Villages are driving financial inclusion and reshaping credit delivery. By 2030, we anticipate a robust digital lending ecosystem that caters to diverse customer needs.

3. Process Automation: The Key to Adaptability

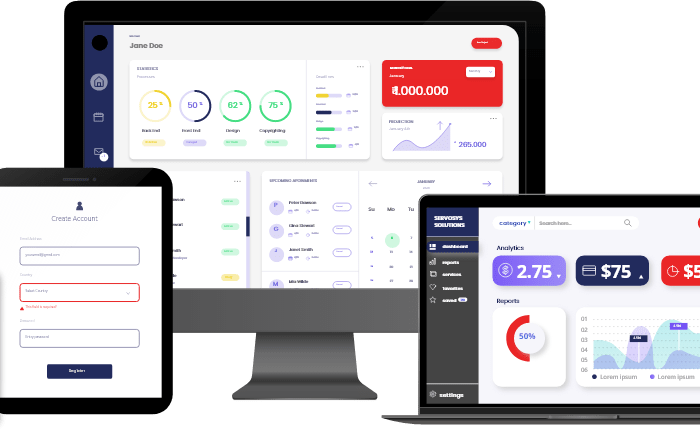

As customer expectations evolve, process automation becomes critical. Digital lending solutions offer speed, efficiency, and personalized experiences. By automating customer acquisition, disbursement, and recovery processes, lenders can adapt swiftly to market dynamics.

The Road Ahead

Looking ahead to 2030, digital lending will continue to thrive. We envision a landscape where process automation will be the bedrock of this transformation, enabling lenders to serve a broader customer base effectively.

Transform your Lending Today!

Innovate, simplify, and expand with cutting-edge process automation solution.

- Gold Loan

- Consumer Durable

- Home Loan

- Microfinance

- MSME Loan

- Education Loan

- Construction Finance

- Corporate Loan

- Personal Finance

- Vehicle Loan