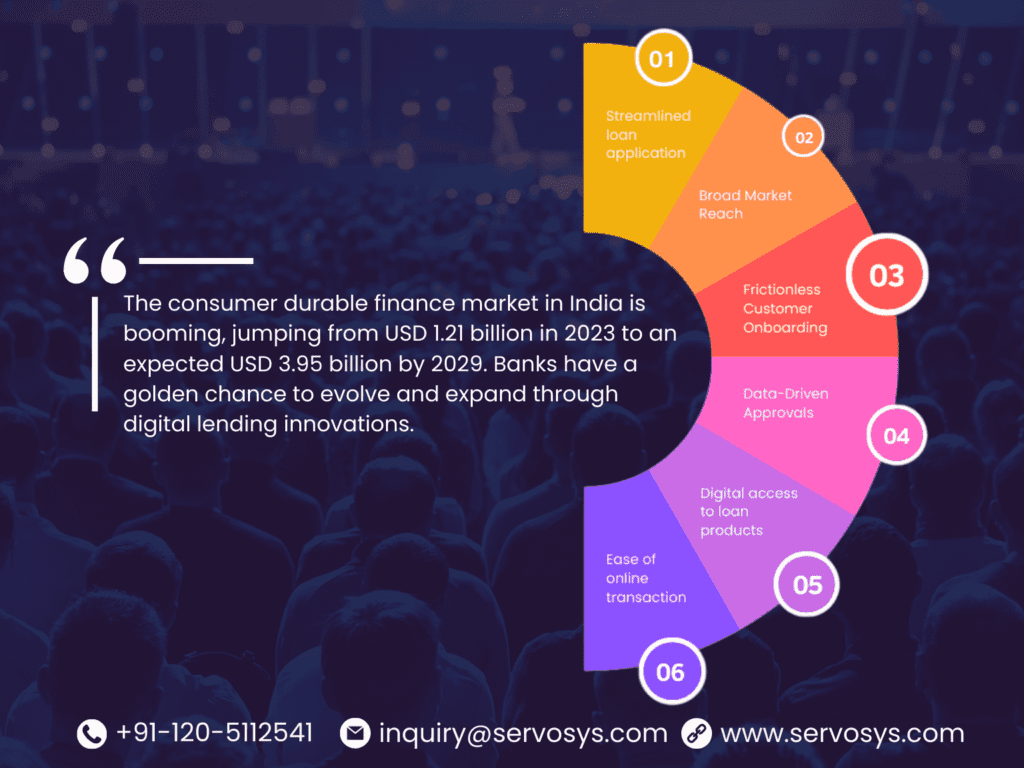

How Market Trajectory is Fueling Innovation in Consumer Durable Lending for Indian Banks?

The consumer durable finance market in India has witnessed remarkable growth, surging from USD 1.21 billion in 2023 to a projected value of USD 3.95 billion by the end of 2029. This impressive trajectory presents a significant opportunity for Indian banks, but traditional lending models are struggling to keep pace.

Cumbersome Applications Hinder Growth

Current loan application processes remain lengthy and complex. A study by Assocham Social Responsibility Council (ASRC) in 2021 revealed that over 40% of online shoppers in India abandon purchases due to lengthy loan application procedures. Consumers, accustomed to the ease of online transactions, expect a faster and more streamlined loan application process.

Limited Reach Excludes Valuable Customers

Traditional loan options often rely heavily on credit scores, excluding a sizeable segment of the Indian population. A Credit Suisse report in 2023 suggests that nearly 60% of potential borrowers in India, particularly younger demographics, fall outside the typical credit score range for consumer durable loans. This limits the potential customer base for banks and hinders overall market growth.

Disconnected Loan Process Creates Friction

The disjointed nature of loan applications and product purchases creates a frustrating experience for consumers. A 2022 survey by LocalCircles, a social media platform for Indian businesses, found that 38% of respondents abandoned purchases due to the disconnect between loan application and product selection. This disconnect creates unnecessary friction in the buying journey, leading to lost sales for both banks and retailers.

Data Empowers Banks, AI Streamlines Approvals

Forward-thinking banks are leveraging market insights to develop innovative consumer durable lending solutions. One key strategy involves utilizing alternative data sources beyond credit scores. A study by the Reserve Bank of India (RBI) in 2022 demonstrates the efficacy of alternative data, such as bank statements or utility bill payments, in accurately assessing creditworthiness for underbanked populations. Additionally, Artificial Intelligence (AI) is transforming the loan approval process. A 2023 report by McKinsey & Company highlights that AI-powered solutions can significantly reduce approval times by up to 70%, leading to faster access to financing for consumers.

Robust Credit Assessments and Approvals

By embracing market insights and implementing innovative solutions, Indian banks can unlock significant benefits. A study by CRIF High Mark, a credit information bureau, in 2022 suggests that data-driven credit assessments and AI-powered approvals can lead to a 30% rise in loan origination for consumer durables. Additionally, streamlined applications and faster approvals translate to enhanced customer satisfaction. A 2023 Assocham survey suggests a potential 20% increase in customer loyalty for banks offering faster and more convenient loan application processes. Retailers also benefit from this new paradigm. Research by RAI (Retailers Association of India) in 2023 indicates that readily available financing options through embedded finance can boost consumer durable sales by up to 15%.

Examples of Innovation in Action

Several Indian banks are already exploring these innovative solutions. A largest private bank of India has partnered with Servosys Solutions to offer DIY journeys on loan approvals for consumer durables.

Conclusion:

The innovative consumer durable lending solutions not only unlocks new revenue streams but also fosters a more inclusive and customer-centric lending experience, reimagining how banks serve the ever-evolving needs of consumers in the booming Indian consumer durables market.

Transform your Lending Journeys!

Innovate, simplify, and expand with cutting-edge process automation solution.

- Gold Loan

- Consumer Durable

- Home Loan

- Microfinance

- MSME Loan

- Education Loan

- Construction Finance

- Corporate Loan

- Personal Finance

- Vehicle Loan