Customer expectations have transformed dramatically in the last few years. Borrowers today demand instant approvals, seamless digital experiences, and complete transparency. Yet many banks and NBFCs continue to rely on traditional loan origination workflows—manual underwriting, lengthy document checks, and disconnected systems—that slow them down and restrict their ability to scale.

This operational lag doesn’t just frustrate internal teams; it directly impacts the bottom line. Slow loan processing leads to higher drop-offs, increased operational costs, and a widening gap between what customers expect and what institutions can deliver. The reality is undeniable: outdated processes hold lenders back, while agile, digitally mature competitors move ahead.

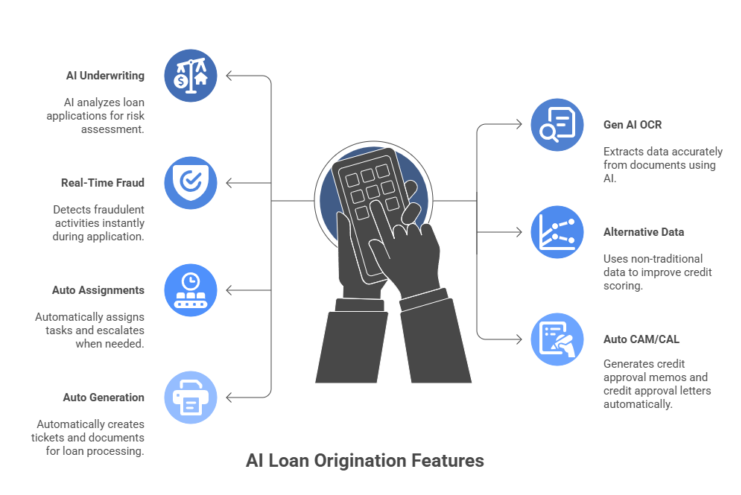

This is where intelligent automation and AI-driven lending make all the difference. Modern lenders are increasingly adopting these capabilities to speed up decisions, reduce risk, and deliver superior customer experiences. In this blog, we break down the most impactful AI and automation features for enterprises seeking upgrades/shift in their lending practices with an AI-powered Loan origination software.

Think back to how underwriting used to work—layers of paperwork, manual assessments, and multiple back-and-forths. Not only was it slow, but results also depended heavily on individual judgment.

AI-powered loan origination software changes the game completely. With machine learning, predictive analytics, and pattern recognition capabilities, underwriting has become:

With AI-driven underwriting, Banks can instantly evaluates bank statements, transactions, credit behavior, and risk signals. Instead of days, decisions now happen in minutes—sometimes seconds. This means your team spends more time on strategic decisions and exceptions, while the system handles the heavy lifting.

If there’s one thing almost every lender struggles with, it’s document processing. From blurry PDFs to handwritten forms, document quality and formats vary drastically.

GenAI-powered OCR solves this with intelligent understanding rather than just text recognition. It can:

Imagine being able to process income proofs, KYC documents, utility bills, bank statements—even complex forms—quickly and accurately. That’s the value GenAI brings.

Fraud attempts have become more sophisticated, especially with digital lending on the rise. Traditional fraud checks often detect issues after disbursement, which is too late.

AI-powered LOS solutions with fraud detection does the opposite—it works proactively. It can examine:

And it flags potential fraud instantly. The result? Stronger compliance, reduced losses, and faster approvals for genuine customers.

Millions of borrowers today fall into the “thin-file” category—especially young professionals, gig workers, and new-to-credit customers. Traditional scoring models don’t give a complete picture of these borrowers.

With AI-driven alternative data scoring, lenders can now include:

This expanded dataset not only widens your potential customer base but also allows you to assess risk with far greater accuracy and confidence. By bringing more under-served borrowers into the fold, lenders can unlock stronger portfolio growth, better-quality decisions, and a more inclusive lending ecosystem overall.

Beyond smarter decision-making, AI-led automation plays a crucial role in optimizing internal lending operations. It helps financial institutions build an end-to-end workflow that is faster, more reliable, and dramatically more efficient.

Handling application assignments manually is slow, inconsistent, and often frustrating for both customers and loan officers. With automated assignment and escalation features, the system intelligently routes new applications or tasks to the right team members based on predefined rules—such as loan category, risk profile, geography, or current workload.

If any case is delayed, idle, or marked as high-risk, the platform instantly escalates it to the appropriate personnel or senior officer. This ensures timely action, faster loan processing, and zero missed follow-ups.

Preparing Credit Appraisal Memos (CAM) or Credit Analysis Reports (CAL) is essential but time-consuming for credit officers. Automation simplifies this by automatically gathering relevant customer data, financial statements, risk insights, and scoring details into a ready-to-review format.

This allows officers to focus on strategic evaluation instead of spending hours compiling reports manually.

In fact, ServoSys helped India’s 2nd largest private bank reduce TAT by 84% and achieve 100% compliance accuracy through automated CAM/CAL generation.

Tickets, alerts, and document creation often become bottlenecks in traditional lending workflows. With automated ticketing, the system instantly generates tickets for missing documents, mismatched details, or required approvals—keeping every case moving smoothly.

Once a loan is approved, the platform can automatically generate sanction letters, loan agreements, and other critical documents using pre-filled data and standardized templates. This ensures accuracy, compliance, and faster turnaround while reducing manual effort across teams.

These capabilities are just the beginning—only a glimpse of what AI and automation can unlock for modern lenders. With the right strategy, financial institutions can streamline processes, reduce turnaround times, strengthen compliance, and deliver the seamless digital experiences customers now expect.

At Servosys, we’re committed to helping Banks and NBFCs overcome everyday operational challenges with intelligent, proven solutions trusted by leading enterprises. Our AI-powered Loan origination solutions and document management system are designed to minimize manual work, eliminate bottlenecks, and enable teams to work smarter, not harder.

If you’re ready to accelerate your lending transformation and stay ahead of operational barriers, we’d love to partner with you.

Let’s connect and move your lending process toward a faster, more efficient, and future-ready model.

FAQs on Loan Origination Software ( LOS solutions)

Our AI-led loan origination system offers end-to-end automation across the lending lifecycle. Key capabilities include AI-driven underwriting, GenAI-powered OCR for intelligent document extraction, real-time fraud detection, alternative data scoring, and workflow automation features like auto assignments, CAM/CAL generation, and ticket/document automation. Together, these features streamline processes, reduce manual effort, and enable faster, more accurate loan decisions.

We have deployed solutions across a variety of lending types, including personal loans, home loans, vehicle loans, MSME financing, and digital lending for thin-file borrowers. Our platforms are flexible, scalable, and customizable, allowing banks and NBFCs to adapt to specific business models, regulatory requirements, and customer needs.

AI-driven underwriting leverages machine learning and predictive analytics to evaluate borrower risk instantly. By analyzing credit behavior, financial history, and alternative data, the system delivers faster, consistent, and unbiased decisions. This reduces turnaround time from days to minutes while minimizing human errors and enhancing portfolio quality.

The platform automates critical compliance tasks, such as CAM/CAL generation, document verification, and workflow escalation. Automated checks and audit trails reduce errors, ensure adherence to regulatory standards, and prevent bottlenecks caused by manual processing. This enables faster approvals without compromising compliance.

Yes. By leveraging alternative data sources like utility payments, digital transactions, and mobile usage, the platform enables lending to thin-file or new-to-credit customers. This expands the customer base, promotes financial inclusion, and allows lenders to make informed, risk-adjusted lending decisions beyond traditional credit scores.

Innovate, simplify, and expand with cutting-edge process automation solution.

Servosys Solutions is a unit of EML Consultancy Services Private Limited, a company headquartered in New Delhi, India. We are one of the fastest-growing providers of software products and technology services for business process automation solutions that address challenges like process turn-around time, organizational productivity, regulatory compliance, business scalability, operational visibility and excellence.

Adding {{itemName}} to cart

Added {{itemName}} to cart