AI-powered origination reduces loan approval TAT from days to just hours.

Real-time analytics ensures compliance with automated RBI reporting and NPA risk alerts.

Servosys Commercial Banking Solutions improve CX with faster, transparent loan journeys.

Automated CAM/CAL and borrower portals streamline workflows and strengthen engagement.

Banks achieve 84% faster disbursement and 4X higher loan bookings with Servosys.

In commercial banking, speed and accuracy are no longer optional—they are the new benchmarks for success. Traditional loan origination, once bogged down by paperwork and manual checks, cannot meet the expectations of today’s business customers. Companies demand quick, transparent, and reliable access to credit, while banks need to minimize risks and maintain compliance.

This is where Commercial Lending Software Solutions powered by AI-driven origination systems bring real transformation. By automating repetitive tasks, integrating with third-party systems, and empowering stakeholders with real-time insights, banks and NBFCs can accelerate loan approvals, enhance customer experience, and reduce operational risks.

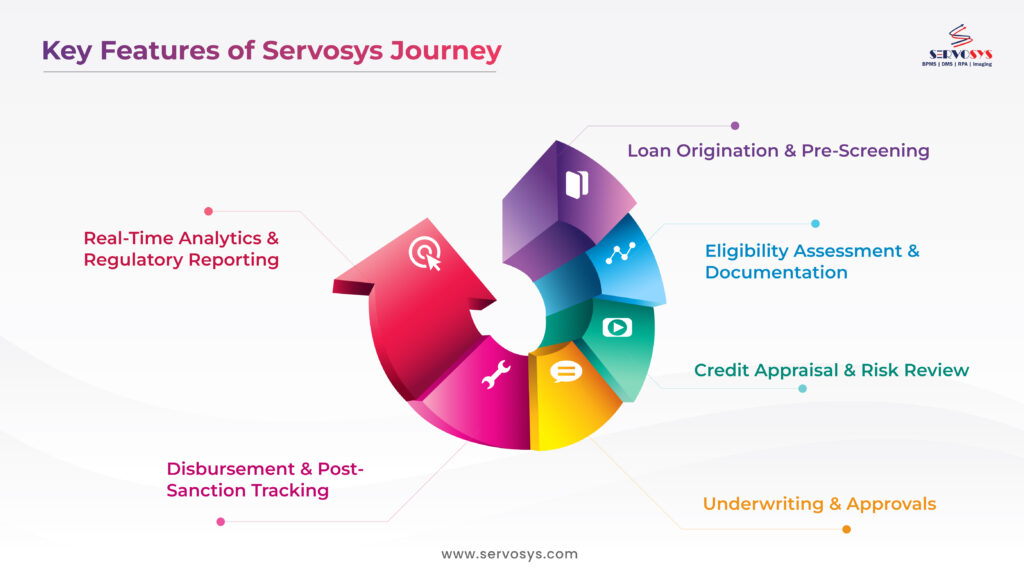

Servosys’ Commercial Lending Software is built on well-structured journeys that cover every phase of lending. These journeys ensure that customers, sales managers, credit managers, and technology systems all work in sync for maximum efficiency.

Servosys’ Commercial Banking Solutions address diverse lending scenarios:

These use cases demonstrate how automation helps banks scale lending operations while improving compliance and customer trust.

Enhanced Approved Loan Quality with 100% Compliance

About the Customer

India’s second-largest private bank, with 5,900+ branches and operations across 17 countries.

Business Challenges

Solution Delivered

Benefits Achieved

This case shows how Commercial Banking Solutions powered by Servostreams8.0 can transform the lending experience, helping even the largest banks achieve speed, compliance, and customer satisfaction.

AI-powered origination systems, like Servosys’ platform, bring measurable benefits:

Commercial banking is no longer about who has the largest network—it’s about who delivers the fastest, smartest, and most reliable lending experience. With AI-driven Commercial Banking Solutions, banks can cut decision times, reduce risks, and create stronger customer relationships.

Servosys empowers lenders to unify their stakeholders on a single platform, turning fragmented workflows into seamless journeys. From origination to disbursement, every step becomes faster, more accurate, and fully compliant.

The winning strategy for modern banks lies in adopting digital-first lending platforms today. With Servosys’ Commercial Lending Software, you can achieve measurable improvements in turnaround, risk management, and customer satisfaction—ensuring sustainable growth in a competitive market.

FAQs on Commercial Lending Software

A Commercial Banking Solution is software that automates the corporate loan process—from origination and credit appraisal to disbursement and monitoring—helping banks and NBFCs improve efficiency and compliance.

AI in Commercial Lending Software speeds up loan approvals by automating pre-screening, risk scoring, and eligibility checks, reducing turnaround time from days to just hours.

Servosys’ Commercial Banking Solutions deliver faster loan approvals, 84% TAT reduction, stronger compliance, 360° visibility for managers, and improved customer satisfaction.

Commercial Lending Software ensures compliance with RBI guidelines through automated audit trails, waiver management, deviation tracking, and covenant monitoring.

Yes. Commercial Banking Solutions handle working capital loans, term loans, SME finance, mid-corporate lending, and project finance with customized workflows.

AI-powered loan origination systems help banks cut approval delays, reduce paperwork, improve visibility, and lower operational risks while minimizing NPAs.

They enhance customer experience by enabling digital onboarding, document upload, real-time loan tracking, and faster approvals for a transparent journey.

Banks should adopt Commercial Banking Solutions to stay competitive, achieve faster growth, reduce credit risk, and deliver digital-first customer experiences.

Innovate, simplify, and expand with cutting-edge process automation solution.

Servosys Solutions is a unit of EML Consultancy Services Private Limited, a company headquartered in New Delhi, India. We are one of the fastest-growing providers of software products and technology services for business process automation solutions that address challenges like process turn-around time, organizational productivity, regulatory compliance, business scalability, operational visibility and excellence.

Adding {{itemName}} to cart

Added {{itemName}} to cart