Robotic Process Automation Software: Benefits And Use-Cases

In today’s environment, organizations use software robots to do day-to-day business tasks by replicating how humans interact with software application systems. The fast-rising market for Robotic Process Automation (RPA) suggests significant developing trends; moreover, competitive, and financial challenges compel enterprises to become more efficient and seek new technologies and approaches to become more productive. Robotic process automation may free up personnel for more difficult and complex tasks that offer value to a business as well as to an organization.

RPA is described as the use of software technologies to make it simple to create and maintain software robots. This technique is built on software and algorithms with the goal of automating repetitive tasks. Software robots comprehend what is displayed on the screen, make the appropriate keystrokes, recognize, and navigate systems, and carry out a variety of predefined operations. Organizations are starting to use robotic process automation in conjunction with cognitive technologies like Natural Language Processing, Speech Recognition, and Machine Learning. The combination of cognitive technologies and robotics process automation is expanding automation into new sectors and assisting organizations in being more efficient and adaptable as they transition to becoming completely digital firms.

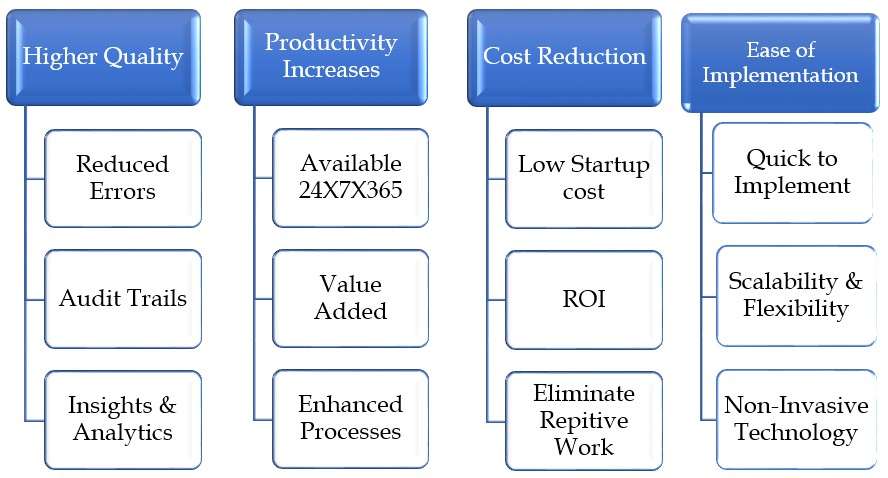

In today’s economic context, organizations must be cost-efficient to survive or keep market share, and RPA can dramatically decrease costs. It also boosts staff and consumer satisfaction, as well as engagement. RPA is a non-invasive technology that may be quickly adopted to expedite digital transformation.

Recent trends such as Globalisation, Greater supervision and regulatory pressure, new competitive entrants, and shrinking margins compel financial institutions to seek innovative methods to minimize costs, generate revenue, and enhance overall efficiency. The implementation of RPA in the banking, insurance, and financial sectors is a natural match since this area is predicted to have the highest RPA growth and provides a solid indicator of RPA’s potential influence soon. RPA can give a solution and assist businesses in reducing operating expenses. Few financial firms have previously employed RPA in financial tasks; the robots are meant to give financial advice or portfolio management online with little or no human intervention. These robots function in the same way as human service advisers do. These robots are particularly popular for portfolio management since they are inexpensive and allow small investors to obtain investing advice.

The table below is a very simplified overview of the different divisions in the financial industry; it provides a possible explanation for why the Banking, Financial Service & Insurance (BFSI) industry is an ideal candidate for Robotic Process Automation (RPA), demonstrating that the possibilities are limitless.

Application of RPA in BFSI Domain